Qualified dividends and capital gains tax worksheet for 1040 line 11a. 2018 qualified dividends and capital gain tax worksheet.

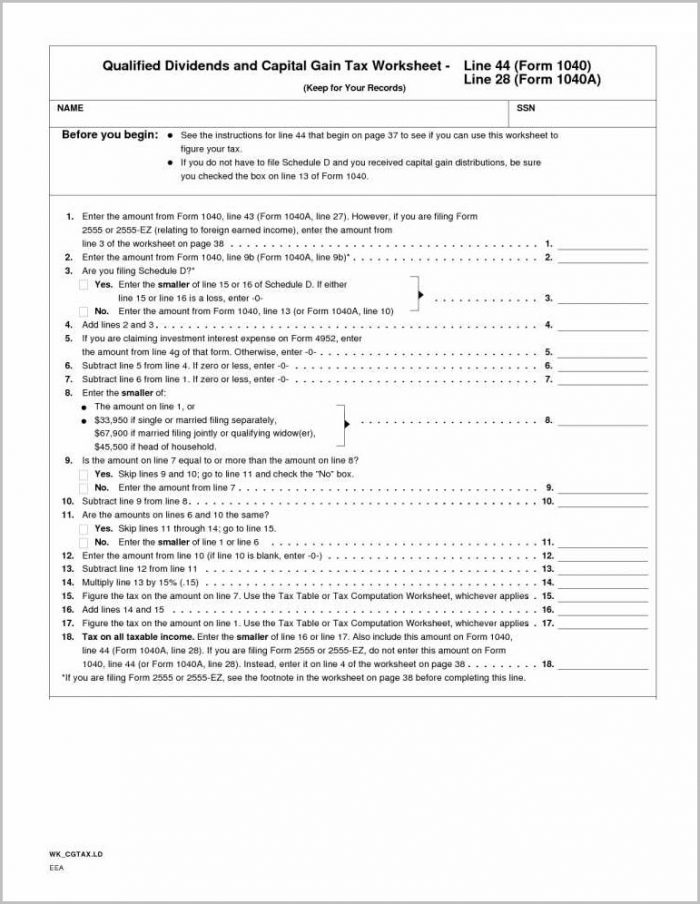

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

Qualified dividends worksheet. Report your qualified dividends on line 9b of form 1040 or 1040a. On average this form takes 7 minutes to complete. Qualified dividends and capital gain tax worksheetline 44.

Keep for your records. Some of the worksheets displayed are 2018 form 1041 es 2018 form 1040 es 2018 estimated tax work keep for your records 1 2a 44 of 107 pacific grace tax accounting qualified dividends and capital gain tax work an 2017 qualified dividends and capital gain tax work qualified dividends and capital. Before completing this worksheet complete form 1040 through line 10.

Showing top 8 worksheets in the category 2018 qualified dividends. Before completing this worksheet complete form 1040 through line 43. Qualified dividend tax rates and ordinary dividend tax rates are two different categories.

The qualified dividends and capital gains tax worksheet 1040 line 11a form is 1 page long and contains. So lines 1 7 of this worksheet are figuring what is your total qualified income line 6 and your total ordinary income line 7 so they can be taxed at their different rates. See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.

If you do not have to file schedule d and you received capital gain distributions be sure you checked the box on line 13 of schedule 1. Be sure to use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to calculate the tax on qualified dividends at the preferred tax rates. Heres how to know if your dividends qualify for the lowest tax rates and what it could mean to your wallet.

Non dividend distributions reduce your cost basis in the stock by the amount of the distribution. Qualified income is the sum of long term capital gains and qualified dividends minus anything you decided to take as income on form 4952 dont do that. 2019 qualified dividends and capital gain tax.

Showing top 8 worksheets in the category 2019 qualified dividends and capital gain tax. Some of the worksheets displayed are 44 of 107 2019 form 1041 es 2018 form 1041 es 2018 estimated tax work keep for your records 1 2a schedule d capital gains and losses unsupported calculations and situations in the 2018 i 335 question of the week. Qualified dividends and capital gain tax worksheet form 1040 instructions page 40.

Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. Qualified dividends are reported on line 3a of your form 1040. Qualified dividends and capital gain tax worksheet form 1040 instructions html.

Taxact 2018 And The Foreign Tax Credit Bogleheads Org

Taxact 2018 And The Foreign Tax Credit Bogleheads Org  18 New Qualified Dividends And Capital Gain Tax Worksheet Line 44

18 New Qualified Dividends And Capital Gain Tax Worksheet Line 44  1040 2018 Internal Revenue Service

1040 2018 Internal Revenue Service  All You Need To Know About Qualified Dividends

All You Need To Know About Qualified Dividends  Solved Create A Function For Calculating The Tax Due For

Solved Create A Function For Calculating The Tax Due For  Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form  1040ez Fillable Form Worksheet Unique Inspirational What Is Online

1040ez Fillable Form Worksheet Unique Inspirational What Is Online  All You Need To Know About Qualified Dividends

All You Need To Know About Qualified Dividends

0 comments